Colorado Income Tax Calculator 2025. Colorado income tax calculator 2025. So, only $8,050 receives this tax rate.

4.40% the colorado income tax estimator. For single tax filers, social security benefits aren’t taxed if your provisional income is less than $25,000.

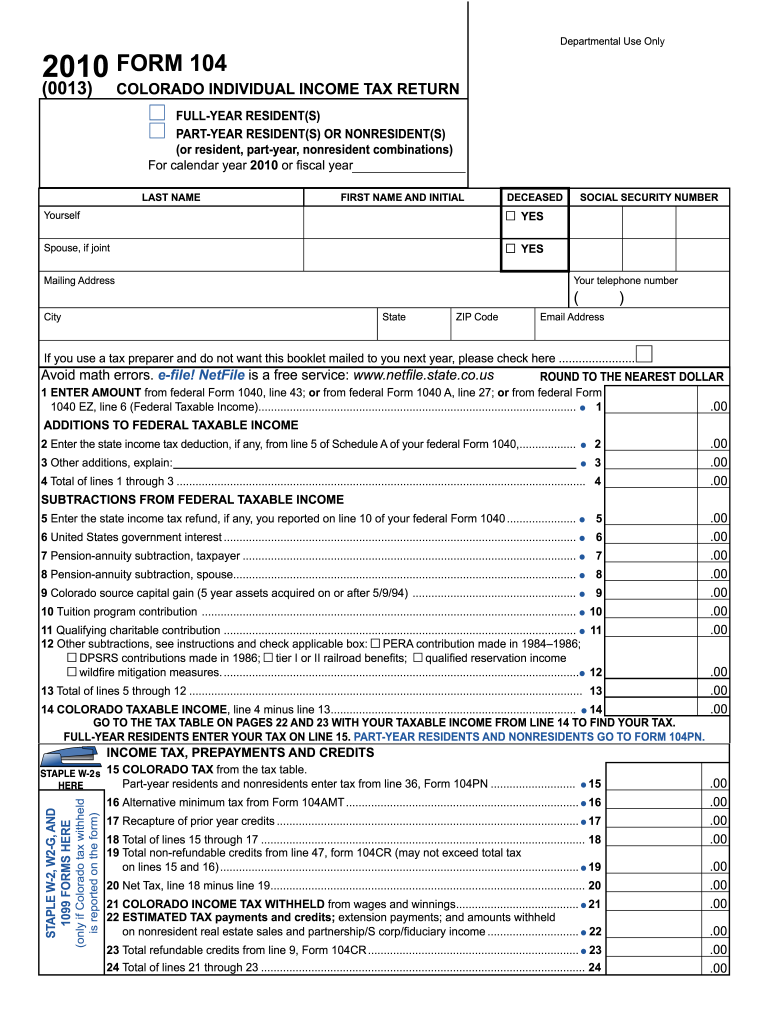

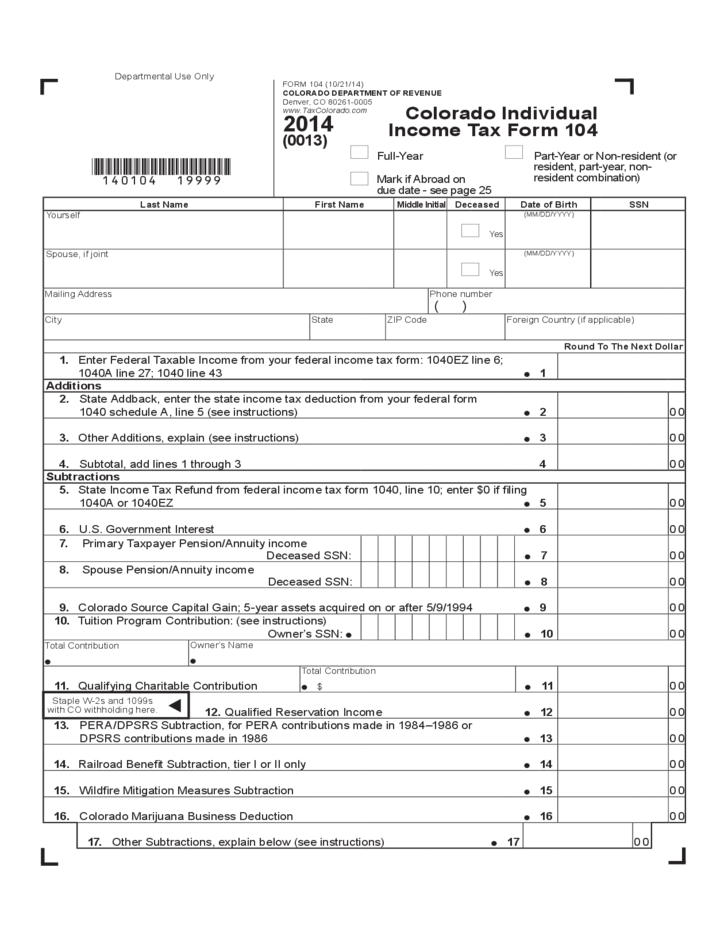

Form 104 colorado Fill out & sign online DocHub, Colorado salary and tax calculator features. Us salary tax calculation for 2025 tax year based on annual salary of $ 200,000.00.

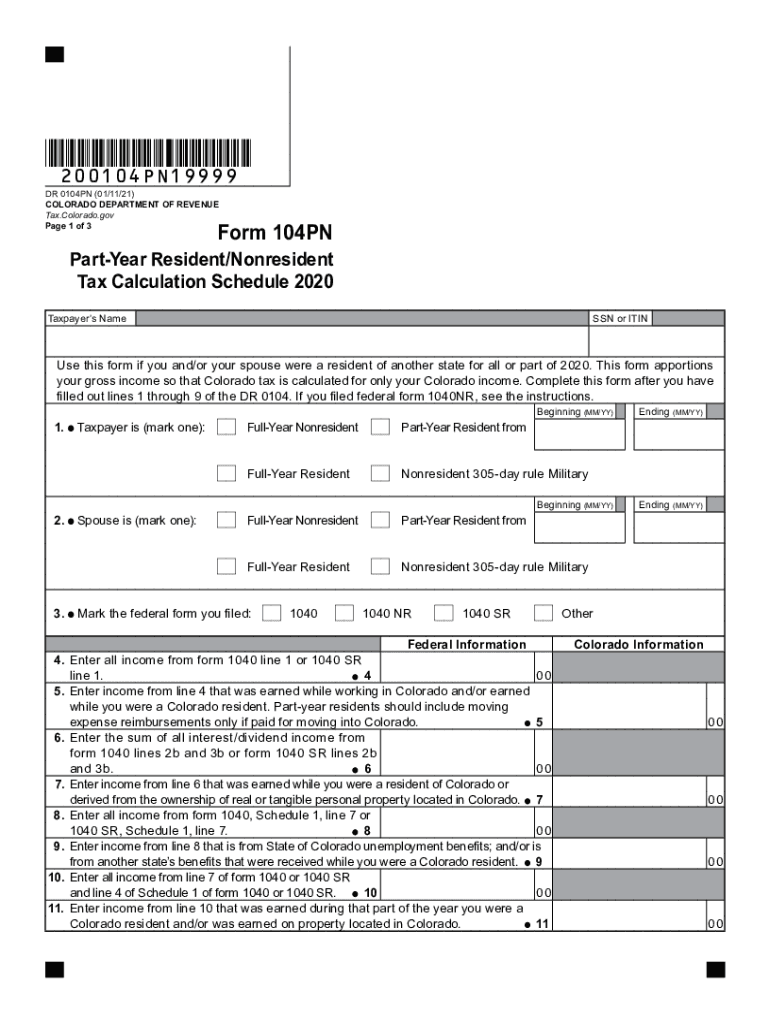

Colorado form 104pn Fill out & sign online DocHub, Updated for 2025 with income tax and social security deductables. Colorado state tax quick facts.

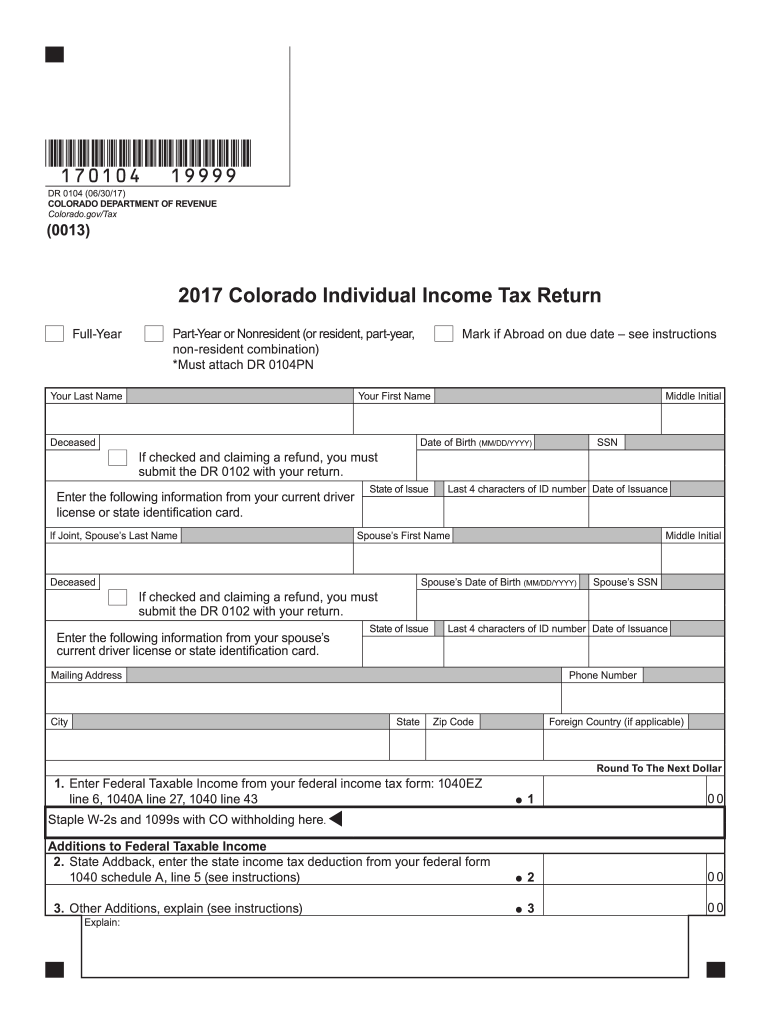

Colorado tax Fill out & sign online DocHub, The deadline for filing a colorado state tax return is april 15, 2025. Find out how much your salary is after tax.

Colorado based tax form Fill out & sign online DocHub, Marginal tax rate 22% effective tax rate 10.94% federal income tax $7,660. Colorado salary and tax calculator features.

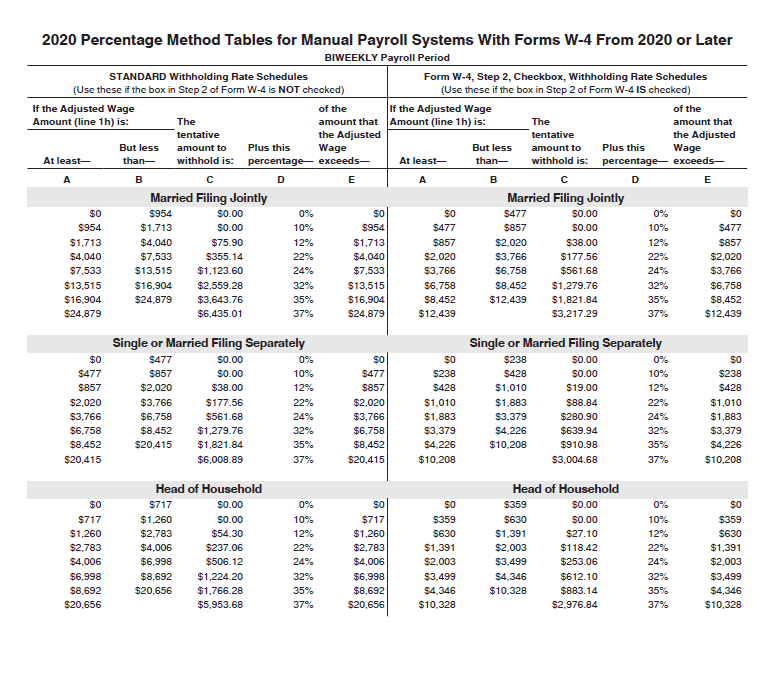

Tax rates for the 2025 year of assessment Just One Lap, 2025 2025 2025 2025 2025* select your filing status. Here, you will find a comprehensive list of income tax calculators, each tailored to a.

Colorado State Tax S Printable 20192024 Form Fill Out and Sign, Colorado's income tax has a single flat tax rate for all income. 22 cents per gallon of regular gasoline, 20.5 cents per gallon of diesel

Printable Colorado Tax Form 104 Printable Form 2025, Marginal tax rate 22% effective tax rate 10.94% federal income tax $7,660. Updated for 2025 with income tax and social security deductables.

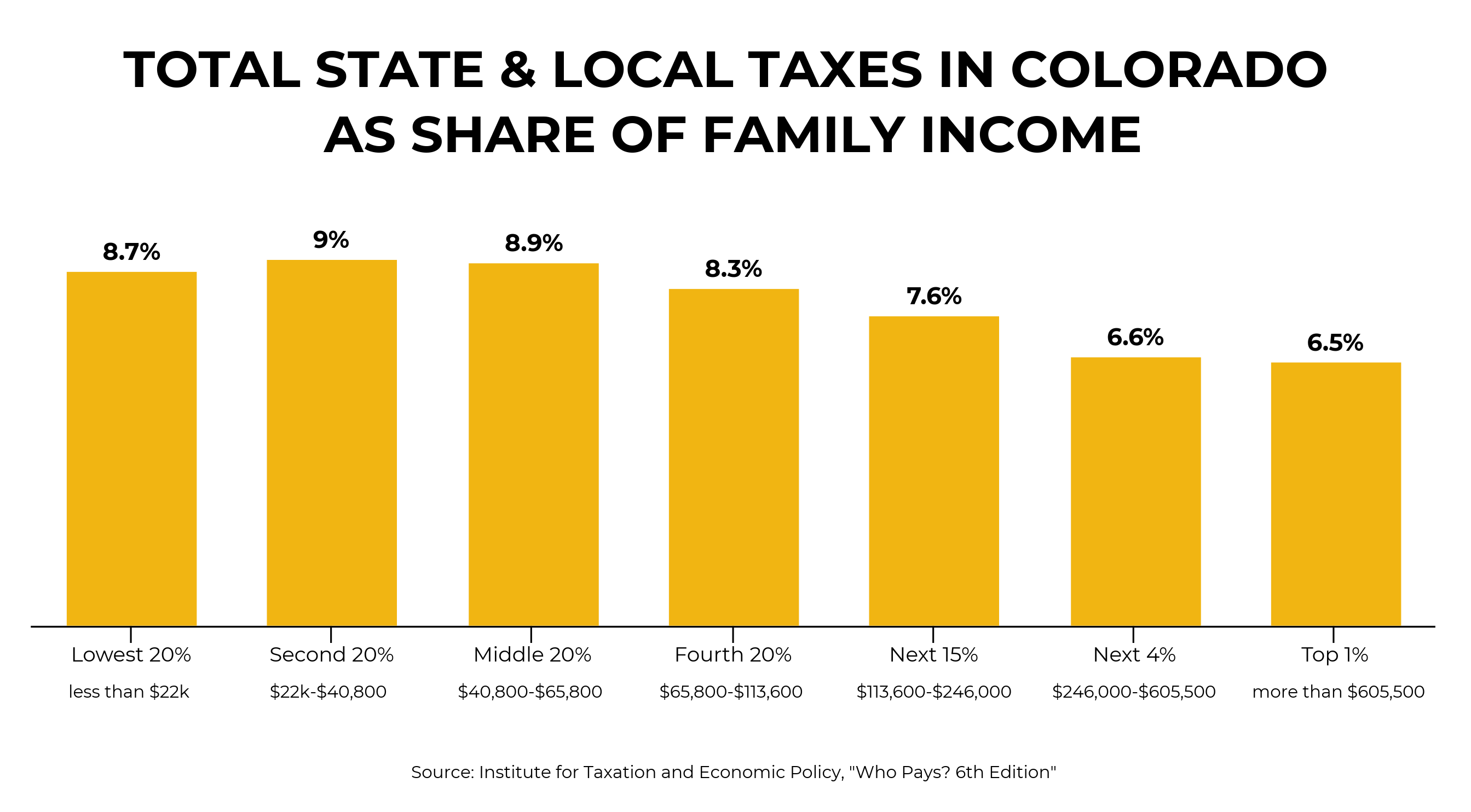

Ranking Of State Tax Rates INCOBEMAN, Colorado state tax quick facts. Colorado state income tax tables in 2025.

Learn More Quick Facts on a Fair Tax for Colorado, 4.40% the colorado income tax estimator. Marginal tax rate 22% effective tax rate 10.94% federal income tax $7,660.

Colorado Tax Withholding 2025 2025 W4 Form, The colorado tax calculator includes tax. Welcome to the 2025 income tax calculator for colorado which allows you to calculate income tax due, the effective tax rate and the.