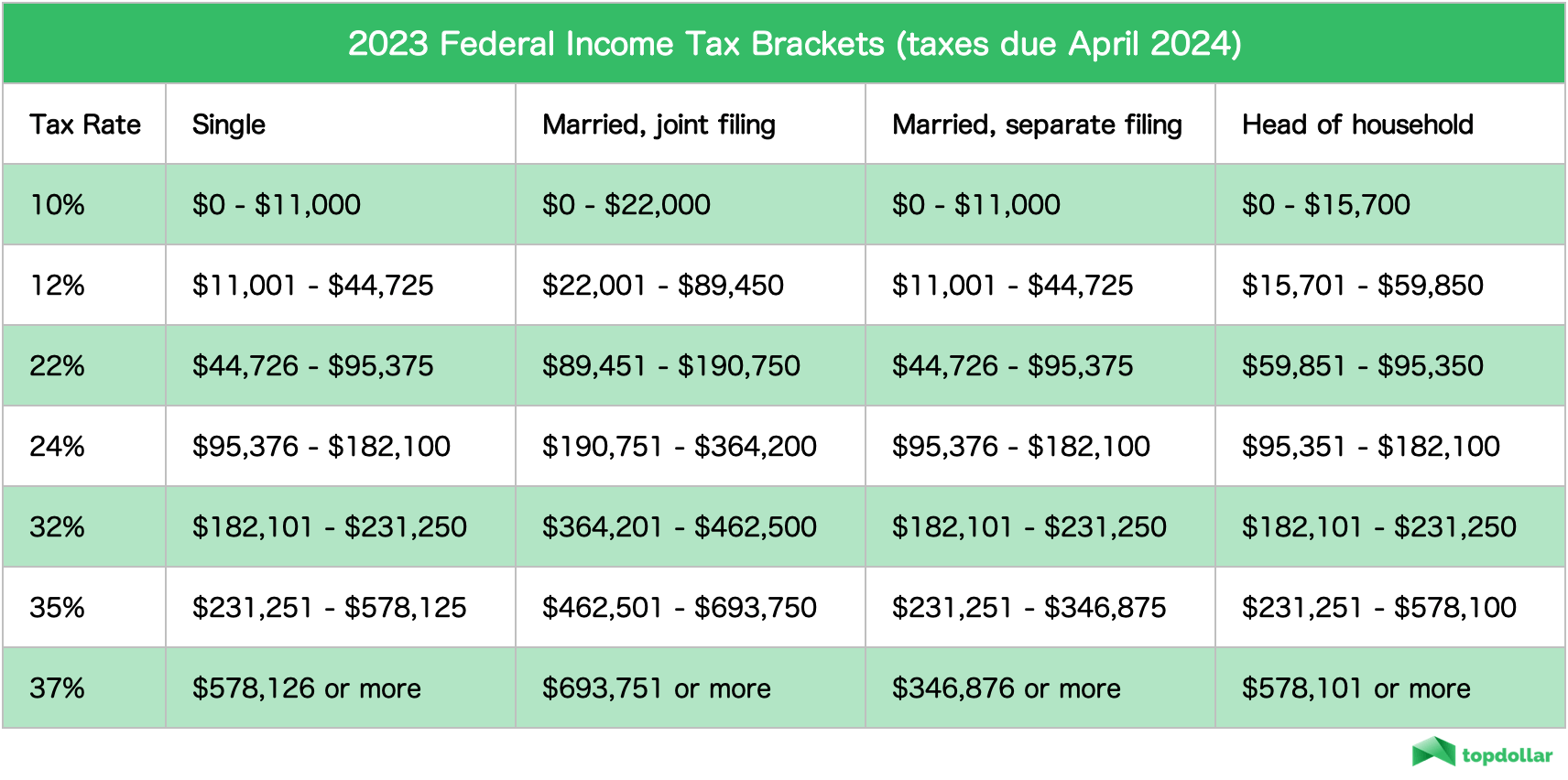

2025 Irs Federal Tax Brackets. The marginal rates — 10%, 12%, 22%, 24%, 32%, 35% and 37% — remain. The 2025 tax year, and the return due in 2025, will continue with these seven federal tax brackets:

The tax agency on thursday said it’s adjusting the tax brackets upwards by 5.4%, relying on a formula based on the consumer price index, which tracks the costs of. Tax brackets for people filing as single individuals for 2025.

Here are the federal tax brackets for 2025 vs. 2025 Narrative News, There are seven tax brackets for most ordinary income for the 2025 tax year: Tax brackets for people filing as single individuals for 2025.

Federal Tax Revenue Brackets For 2025 And 2025 Nakedlydressed, Tax brackets and tax rates. Tax brackets for people filing as single individuals for 2025.

Washington Tax Brackets 2025 Collie Katleen, Adjustments to tax brackets and. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent and 37 percent.

2025 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, Below, cnbc select breaks down the updated tax brackets for. Features 2025 and 2025 tax brackets and federal income tax rates.

Tax filers can keep more money in 2025 as IRS shifts brackets Andrews, In 2025 (for the 2025 return), the seven federal tax brackets persist: There are seven federal income tax rates in all:

Irs Withholding Rates 2025 Federal Withholding Tables 2025, The marginal rates — 10%, 12%, 22%, 24%, 32%, 35% and 37% — remain. Adjustments to tax brackets and.

2025 Irs Tax Table Chart, There are seven federal income tax rates in all: Features 2025 and 2025 tax brackets and federal income tax rates.

Federal Tax Table For 2025 Becca Carmine, The more you make, the. There are seven tax brackets for most ordinary income for the 2025 tax year:

Us Tax Revenue By Bracket Designbyraquel Rezfoods Resep, Individual brackets were determined by filing. In 2025 (for the 2025 return), the seven federal tax brackets persist:

110,000 a Year Is How Much an Hour? Top Dollar, Your income each year determines which federal tax bracket you fall into and which of the seven income. The more you make, the.